Thursday, September 27, 2012

Glaxo, Cipla Seen as Biggest Losers as India Sets Prices

Wednesday, September 26, 2012

Consumers want discount for generic medicines - survey

Tuesday, September 25, 2012

Applying for NEW WHO GMP Certificate online

You can apply for new WHO GMP Certificate 60 days prior to expiry of already granted WHO GMP Certificate or can make an application for WHO GMP Certificate for the first time. Please ensure that you have entered the licence, approved product details correctly and completely.

1. Go to "New Application" and Select and click on "WHO-GMP Application". New screen will open.

2. Again click on "New Application". Select certificate type from the drop down list given of Certificate type.

3. If application is for fresh WHO GMP Certificate with annexure, then list of products will appear. The product can be selected for which the said certificate is required.

4. Upload the pdf file of the site master file. For a application by a LOAN Licensee, Upload PDF of Technical agreement between applicant and the OWN licensee and Undertaking of OWN licensee. (Draft formats can be downloaded)

5. Read the undertaking and declaration. If agreed then only you can proceed further with the application.

6. Click on "Proceed". Your application is ready for submission and for further payment of fee.

7. You can preview the draft copy of WHO GMP Certificate which may be issued. This can be previewed for verifying the details. If anything has to be corrected, it can be done here itself, by deleting the application and redrafting (preparing).

8. For making Payment click on "+". The amount will be calculated by the system as per the fee structure notified by FDA and amount will be displayed. You have two options for paying the displayed fees for the application.

a. Deposit at FDA office convenient to you. If the manufacturer selects to pay by cash or DD at convenient FDA office, select "Deposit at FDA office. You can select the convenient FDA office from the drop down list of the FDA offices. Then Click on "Generate Challan" to generate challan in duplicate to be submitted to the selected FDA office. Pay the fees at the Selected FDA office. Obtain receipt.

b. Online Payment through Net Banking: You can pay the fee by internet banking only. Select "Online Payment". Again click on "Online Payment" tab. New window will take you to "Government Receipt Accounting System". Click "Pay Without Registration".New screen will open. Select Department from drop down "FOOD AND DRUG ADMINISTRATION". Select Payment type from drop down as "DRUG MANUFACTURING CERTIFICATE". Select District from drop down as "MUMBAI". Select Office Name from drop down as "COMMISSIONER FOOD DRUG ADMIN". Keep Period (Year) as "2012-2013". Then select "ONE TIME/ ADHOC" from the drop down besides "period". Then select Form ID from drop down as "WHO GMP Certificate" or "COPP" or "SLSPP", as the case may be. Enter amount to be paid. Enter the details as asked in the right block. Then select the bank through which you will be paying. At present the banks through which you can pay are – State Bank of India, State Bank of Hyderabad, Union Bank of India, Indian Overseas Bank, IDBI Bank, Dena Bank, Punjab National Bank, Bank of India, Bank of Baroda, Bank of Maharashtra, Canara Bank only. Submit for payment.

9. After making payment Click on "PAY & CONFIRM". New window will open.enter the details of payment made such as Receipt no / GRN No., date of payment. Upload the pdf copy of the receipt obtained from FDA office (Both sides of receipt) or generated by online payment.

10. Agree with the responsibility statement and then confirm the application by clicking on "CONFIRM". Now your application has been freezed and submitted to the FDA office.

11. Status of the application can be viewed by logging in and going to the new application.

Maharashtra FDA starts online WHO-GMP certification system for manufacturers

The main features of online WHO-GMP certification system for manufacturers will help in saving their time as they will be able to apply online for all the products they manufacture. They can receive certificates faster and has user friendly features.

Maharashtra FDA commisioner Mahesh Zagade said, "Since August 16, 2012 we have stopped taking any applications manually and we have asked all the applicants to submit their applications only through online system." Zagade further added that it is required for all the manufacturers to add the details of the products approved, under the respective licence granted (Form 25 or Form 28, etc). This is necessary while making an application for WHO GMP Certificate or COPP.

Zagade informed that if the applicant wants to apply for new WHO GMP Certificate he should apply within 60 days prior to expiry of already granted WHO GMP Certificate or he can make an application for WHO GMP Certificate for the first time. But he must provide license, approved product details correctly and completely. All the WHO-GMP certificate holders (including loan licensees) should register online and upload all data regarding their products.

FDA has assigned O Sadhwani, Joint Commissioner (Law), FDA, Mumbai to issue certificates: WHO-GMP certificates and Certificate of Pharmaceutical Product(s) to the manufacturers on their request. The validity of COPPs certificates shall be two years from the date of grant of the certificate.

According to the current data, Maharashtra FDA has registered 69 manufacturers (own licensee) and 35 loan licensee holders. Sources from the FDA said, "The manufacturers across Maharashtra are applying online and number is increasing tremendously."

For issuing WHO-GMP certificates, the FDA is charging a fixed sum of money. For fresh WHO-GMP Certificate – Inspection fee (Own) Rs.5000 will be charged for each section, for fresh WHO-GMP Certificate - Inspection fee (Loan) Rs.2000 for each section, for unit WHO-GMP Certificate Rs.1000 for every 10 products, for new COPP with Annexure (with Validation & Stability) Rs.1500, for new COPP without annexure (with Validation & Stability)Rs.1000, for COPP with any type of Annexure Rs.1000, and for COPP without annexure Rs.500.

Monday, September 24, 2012

Linux and Windows: Peaceful Coexistence

One of the stumbling blocks in migrating to the Linux desktop is the mistaken view that you can't take it with you. Your data must remain captive to the Microsoft operating system. Not true at all.

A related misconception that stalls many Windows users from adopting the Linux OS is the belief that when you buy a new computer or install Linux to an existing computer, you must give up one operating system for the other. Again, not true at all.

Like an evangelist, I frequently tell people about a free Windows-like alternative that is faster and more secure than Microsoft's OS. The most common response I get is, "Linux, what's that?"

Often I also hear, "I can't switch systems. I am too busy to start from scratch with all my files." Or, "I'm too busy to go back and forth between two sets of files, one on my Windows computer and the other in my new Linux set up."

But you do not have to suffer either of those inconveniences to migrate to Linux. You can eliminate keeping duplicate files in both operating systems or the need to choose one OS over the other.

The solution is to install the Linux OS as a dual boot on the existing computer and continue to store and access all of your data on the Windows side of the hard drive. This lets you learn Linux in stages as you wean yourself from Microsoft Windows.

This approach works well on home computers and at worker's desks in an office setting. Using cross-platform applications when running the Windows OS makes switching to Linux even more painless.

For example, OpenOffice and LibreOffice are free clones of the Microsoft Office Suite. So you can save and read Word, Excel and PowerPoint files in the same look-alike apps in both Windows and Linux. Plus, Linux has a complete array of text editors and apps to view, create and save your existing and new movie, music and photo files that are compatible in Windows.

Two For One

This strategy works whether you apply it to a new off-the-shelf computer purchase or an existing older Windows PC. Whether desktop or laptop, you get two operating system choices for the cost of one computer. Remember that you pay for the Windows OS in the price of the computer. You also pay for upgrades to newer Windows releases and much of the software you run on Windows. The Linux OS is always free, even new releases. And Linux runs Open Source software, which is also free, so you always have a huge arsenal of great applications to meet your every need.

Whether you buy a Windows PC off the shelf or use your existing aging hardware, install a Linux distro in a separate partition on the hard drive yourself. The Linux installer will automatically create a dual boot GRUB startup screen. Turn on the computer -- or restart it -- to see the selection window. It's that simple!

Since the Linux OS is free, why not have both available even if you never need to boot into Windows? Newer computers will run any version of Linux faster than it runs Microsoft Windows. Some Linux distros specialize in running well on legacy gear.

Windows Plus Linux

Having two operating systems on one computer hurts nothing. Today's hard drives have more than enough storage capacity to handle all of the files from both systems and then some.

Some Linux versions, such as Damn Small Linux and Puppy Linux, run on low-powered older computers. Most Linux distros run from a CD or DVD in a live session without making any changes to the hard drive.

The trick is to access your data whether you run Windows or Linux. You could solve this problem by storing your data in the cloud or on a USB drive. Read on to learn how to keep your files in one location without maintaining duplicate sets of files for Windows and for Linux.

Installing Linux to run on the same computer that runs the Windows OS is not difficult to do, even for novice users. In fact, Linux installation disks automate the process for you.

GRUB Me an OS

When you set up your computer to run multiple operating systems from one hard drive, the start up process involves dualbooting. To do this, you must partition the hard drive.

The Linux installation process does all of the heavy lifting for you. It shrinks the large Windows partition into a smaller one. It creates a new partition and installs the Linux distribution you selected.

Most Linux installation disks include a process that installs GRUB, the Grand Unified Bootloader. GRUB lets you preselect the default OS to run if you do not make a selection in the allotted time.

Windows Is Antisocial

The Windows OS does not recognize the existence of other operating systems. Windows does not provide any way for you to access your other operating systems or files installed alongside it on the hard drive.

But Linux makes up for that Windows personality complex. Nearly all Linux distros recognize Windows on a hard drive. Knowing that Linux sees the Windows partition even when Windows does not reciprocate lets you store all of your documents, videos, music and whatever just where you would put them when using the Windows OS.

This lets you access everything when you run the Linux OS. It eliminates wasted storage space from having duplicate files on two partitions. It also eliminates the troubles associates with not opening the most recent document if you alternate between Windows and Linux often.

The soon-to-be-released Windows 8 OS makes an even more compelling case for migrating to Linux and keeping Windows 7 available in reserve, at least until you work in Linux full time. Windows 8, thanks to Microsoft's pressure tactics against PC makers, will have a mechanism that blocks any other OS from booting.

Finding Your Files

There is only one really tricky part in storing your files on the Windows partition. You must find where your Windows files are located and how to see them using the Linux file directories.

Finding your file storage location is largely a function of how the desktop environment of the distro you use displays the storage locations. For example, you might see icons on the desktop itself showing the Windows and the Linux volumes of the hard drive. Your system might display icons for each volume as well as icons for each plugged in USB drive.

Or your system may not place drive icons on the desktop. But it will let you select all available storage devices as part of the Nautilus or Dolphin or other Linux file manager apps.

Click on the various icons and file manager entries to find where the Windows partition of the hard drive is displayed. You will know you found the right location when you see folders labeled: Program Files, Program Files (x86) and Documents and Settings. The Linux OS does not use these types of folders. Most file manager apps let you bookmark locations for easy return visits.

Getting There

Unlike Microsoft Windows, Linux does not designate hard drive contents with letters (C:, D:. E:, etc.) Instead, Linux uses word labels or a multi-digit numbers for each storage device. The K Desktop Environment, for example, labels the Windows volume after the name of the computer maker in the Devices section of the file listing. It shows The Linux portion as Home in the Computer file listing.

Once you find the volume designation for the Windows OS file side of the hard drive, click on the Documents and Settings folder. Then drill down to the User folder. It will show whatever name you set up when you first ran the Windows OS. Click on this folder to open its content listing.

Now you will see all of the folders that the Windows menu and the Windows File Manager displays when you run that OS. You can click on the various folders that hold your stored data: My Documents, My Pictures, Downloads, Videos, etc.

You can bookmark each of these sub folders in the Linux file manager app or just bookmark the main Windows location. Some Linux distros let you place shortcuts to locations right on the desktop. Then you merely point the file picker dialog box to the appropriate area when you want to open a file in your Linux applications. You can also create new documents and save them to the same Windows OS location.

Safer and Better

Most computer users see a choice between hardware that runs either Apple's or Microsoft's operating system. They usually settle for what they learned to use in school or at work or at home. They are surprised to find out that a third choice -- Linux -- is free and easy to use.

Linux is a mature,stable and reliable operating system. It needs no resource-hogging anti-virus and anti-maleware applications to bog down the computer's performance.

Dual booting into Windows or Linux is easy to set up. Storing all your data files in one place accessible to both OSes makes migrating to Linux a no-brainer.

Sunday, September 23, 2012

HMT sets up counter at Dehradun to reach out to people

|

Registration mandatory for sale of 15 electronic items

|

Standard) on such goods after obtaining registration from the BIS," the statement said.

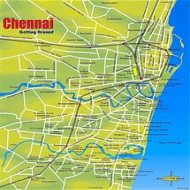

IT sees fall in use of commercial office space in Chennai

|

Current quarter will be better than previous one: MindTree

Tech Mahindra acquires 51% stake in Comviva for Rs 260 cr

|

CRISIL revises Omnitech Infosolutions` fair value to Rs 182

|

Omnitech's domestic business contracted by 4.4% q-o-q to Rs 979 mn as the company is facing pressure due to increased competition at home. Revenues from Europe grew by 44% q-o-q due to fresh orders, which was offset by a decrease of 54% q-o-q and 43% q-o-q in Middle East and US revenues, respectively. Overall, overseas revenues decreased by 2% to Rs 301 mn. The company has shifted its focus more towards India, Europe and Asia Pacific from the US and Middle East businesses.

Omnitech's Asia Pacific subsidiary and Avensus continued to report losses at the EBITDA level of Rs 10 mn each in Q1FY13. Management expects both to break even in Q3FY13. Avensus' profitability is expected to improve as the company will initiate increased offshoring. The company currently offshores 5-7% of Avensus' business. The Asia Pacific subsidiary has received a new order worth Rs 550 mn for FY13, which is expected to increase its margins going forward.

We continue to use the discounted cash flow method to value Omnitech and have revised our earnings estimates downwards for FY13 and FY14 by 17% and 18%, respectively. The revision has factored in a delay in breakeven of Avensus and the Asia Pacific subsidiary, along with higher interest cost due to increased working capital requirement for the subsidiaries. Hence, our fair value is revised to Rs 182 per share from Rs 199. At the current market price of Rs 112, our valuation grade is 5/5.

CRISIL maintains Infinite Computer` valuation grade to 5/5

|

Infinite is trying to recover from the major setbacks of the past three quarters. While business from one of the top clients has reduced, other large client accounts have grown. Infinite has also won large long-term deals over the past quarter, which increases growth visibility. The company plans to scale up the value chain by increasing the share of higher-value services and cross-selling them across all its six verticals. The ability to bag more business from the existing and some of the recently acquired clients will provide an upside.

a) Top five clients continue to contribute a major portion of Infinite's total revenues (73%). Business trimming by any of the large accounts will have a huge impact on Infinite. b) Delays in the government's R-APDRP project have increased debtor days to 102 days, which is much higher than that of its peers.

We expect revenues to register a two-year CAGR of 13.3% to US$ 283 mn in FY14 (17% to Rs 14.4 bn) driven by the messaging platform acquired from Motorola and Infinite's transition to higher-value services such as analytics and mobility. Adjusted EPS is expected to grow at a lower CAGR of 9.0% over FY12-FY14.

CRISIL Research has used the discounted cash flow method to value Infinite at a fair value of Rs 157 per share. This fair value implies P/E multiples of 5.1x FY13E and 4.7x FY14E earnings. We maintain the valuation grade of 5/5.

Cipla wins patent case against Roche

|

Wockhardt's FCCB holders withdraw winding up plea

|